The shrimp industry holds a significant position in India’s total seafood basket. In FY23, the country’s seafood exports amounted to $8 billion, with frozen shrimps commanding a whopping 70 per cent share of this total.

However, the industry has weathered rough times of late. From losing its crown as the world’s top shrimp exporter in 2020 to a COVID-led price crash and rising feed costs, it has faced several headwinds.

Before delving into the reasons why this once-thriving industry went for a nosedive, let’s look at its history.

A background

During the early 1980s, there was a global surge in the demand for shrimps, particularly in China and the US. With the strategic advantage of a tropical climate, expansive coastlines and an abundant workforce, India was perfectly positioned to dive into the burgeoning shrimp farming industry.

The Indian shrimp industry further got a boost when it started cultivating the Vannamei shrimp, in response to the White Spot Syndrome (WSS) that decimated the popular black shrimp populations worldwide. As traditional powerhouses like Vietnam and Thailand saw declines, India’s shrimp market flourished, capturing 90 per cent of its production in the resilient Vannamei variety and fetching lucrative export prices.

Among these, Avanti Feeds stood out, its value soaring twentyfold in just four years during the early 2010s!

Shrimp industry performance: FY13-18

Robust demand and change in shrimp breed has led to phenomenal growth

| Company | Revenue growth (% pa) | Profit after tax growth (% pa) | Median ROCE (%) |

|---|---|---|---|

| Avanti Feeds | 39.2 | 72.8 | 63.5 |

| Apex Frozen Foods | 31.4 | 53 | 27.3 |

| Coastal Corporation | 31.1 | 35.6 | 27.3 |

| Zeal Aqua | 19.7 | 24.1 | 16.5 |

| Waterbase | 16.9 | 37.8 | 17.6 |

| Note: ROCE is return on capital employed | |||

However, the glory days did not last long, as most of the leading shrimp producers, including Avanti Feeds, faced a sharp decline in their profit after tax (PAT). Companies such as Waterbase reported zero revenue growth and a PAT growth of -178.5 per cent between 2019-24.

Shrimp industry performance: FY19-23

Weak demand and other factors brought misery

| Company | Market cap (Rs cr) | Revenue growth (% pa) | Profit after tax growth (% pa) | Median ROCE (%) | 4Y share price return (% pa) |

|---|---|---|---|---|---|

| Avanti Feeds | 6984 | 9.9 | 0.5 | 32.4 | -5.05 |

| Apex Frozen Foods | 682 | 5.2 | -12.4 | 13.3 | -13.35 |

| Coastal Corporation | 392 | -12.5 | -35.1 | 10.7 | -13.1 |

| Waterbase | 344 | 0 | -178.5 | 4.95 | -23.21 |

| Zeal Aqua | 151 | -1.5 | 0 | 11.11 | -11.08 |

| Note: Market cap as of February 16, 2024 | |||||

Let’s look at the factors behind the decline of these companies and the Indian shrimp industry.

COVID crash

As per Fishsite, India’s shrimp sector suffered a massive blow of $1.5 billion due to the pandemic. An unforeseen glut, fueled by supply chain snarls, left shrimp producers drowning in surplus stock during 2020-21.

For instance, Avanti Feeds’ inventory days ballooned from 52 in FY20 to 80 by FY23. Initially spiked by pandemic pressures, the company began hoarding shrimp feed ingredients in FY21, betting on a surge in future prices. However, this gamble turned sour as costs soared and anticipated demand fizzled out in FY23.

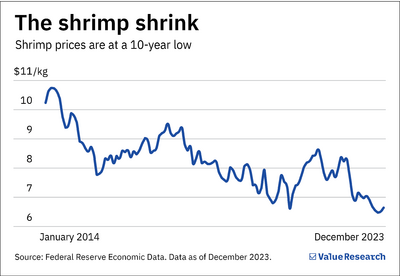

The industry’s woes were further compounded by shrinking appetites for shrimp, thanks to lockdowns and dining restrictions. Consequently, shrimp prices were pushed down to the floor. For instance, the farm gate prices of Vannamei shrimp plunged to $2.88/kg (Rs 236/kg) in FY23, from $3.54/kg (Rs 267/kg) in March 2020, as per the Food and Agriculture Organisation and Global Seafood Alliance.

Although shrimp prices started looking up in FY24, they still remain below pre-pandemic levels.

The export tussle

Traditionally, the US, a leading shrimp importer, has favoured the Indian shrimp. As of FY23, it accounted for 33 per cent of the total shrimp exports by India. Yet, this reliance on the US market has unexpectedly backfired.

Owing to the pandemic, there was a drastic increase in freight costs for shipping, causing a dip in exports. At the same time, Ecuador capitalised on its geographical proximity to Western markets, presenting a logistical edge over its Asian peers. As the US began forging trade agreements and slashing tariffs with Ecuador, it signalled a shift towards diversifying its shrimp sources, reducing its dependency on India. Further, Ecuador’s competitive pricing matched India’s, creating a mutually beneficial scenario for both the US and Ecuador.

The scenario worsened when the US imposed a 3.8 per cent anti-dumping duty on several Indian shrimp exporters in 2023, further challenging India’s competitiveness in the market.

Between September 2021 and September 2022, India witnessed a 12 per cent reduction in shrimp export volumes to the US, whereas Ecuador enjoyed an 11 per cent increase in its export volumes during the same period, as reported by SIAM Canadian. This shift underscores the fluid nature of international trade and the continuous search for more advantageous economic partnerships.

Burgeoning feed costs

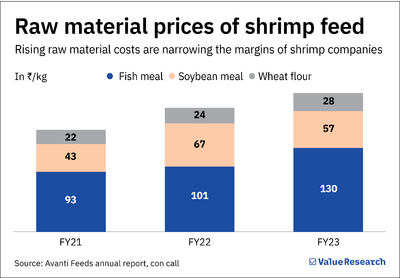

Shrimp feed boasts a specialised diet, crafted to ensure the vitality and growth of shrimp. It is concocted from a trio of essential ingredients: soybean meal, fishmeal and wheat flour. However, the journey to sustaining shrimp health with these nutrients has been fraught with economic setbacks.

Over the past three years, the feed industry has been riding a rollercoaster of price volatility, particularly due to a staggering 40 per cent increase in fishmeal prices due to its global scarcity. This uptick has tightened the purse strings of many farmers, squeezing their profit margins.

What does the future hold for it?

India’s shrimp industry is at a crossroads, caught between opportunity and challenge. As a significant portion of India’s shrimp heads overseas for additional processing, the nation is missing out on a lucrative slice of the revenue pie. Recognising this gap, companies like Avanti Feeds are pivoting towards producing value-added shrimp products. These premium offerings promise higher profit margins than their standard counterparts, signalling a potentially prosperous shift away from mere commodity trading.

In a strategic move to bolster the aquaculture sector, the Indian government is stepping up, slashing customs duties on shrimp feed from a steep 15 per cent down to a more manageable 5 per cent. Further, by setting a daring export goal of Rs 1 lakh crore to revitalising agricultural vigour through the Pradhan Mantri Matsya Sampada Yojna, the government’s actions could herald a new era for aquaculture in India.

Yet, macroeconomic uncertainty continues to exist. The evolving trade dynamics between China and Ecuador, marked by the signing of free trade agreements, loom as a potential storm on the horizon. Should China pivot towards Ecuador for its shrimp supply, the ripple effects could affect India’s aquaculture sector. Hence, the future of India’s shrimp industry hangs in the balance, waiting for the next tide of developments to unfold.