Shrimp on the Brink: How Andhra Pradesh’s Aquaculture Heartland Reached a Breaking Point

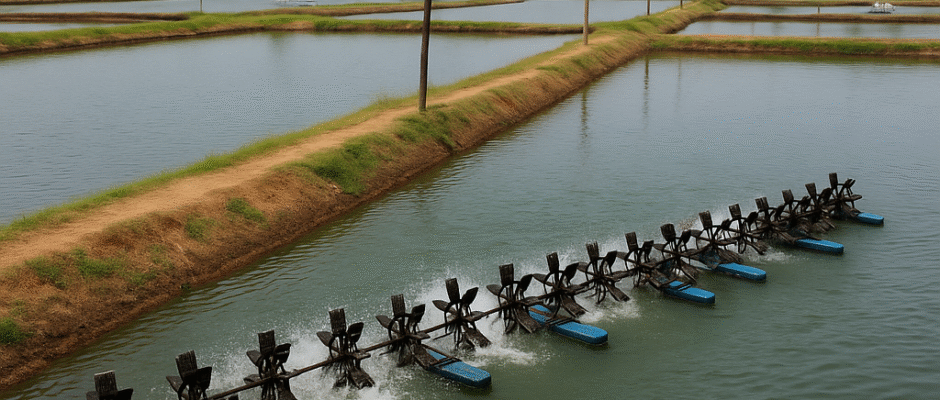

For over a decade, Andhra Pradesh has proudly carried the mantle of being India’s undisputed leader in shrimp aquaculture. Its coastal belts—stretching across West Godavari, Krishna, East Godavari, and Nellore—have produced nearly 70% of the country’s shrimp output, powering India’s meteoric rise as the world’s second-largest shrimp exporter. Yet today, the “Shrimp Capital of India” stands on the edge of an unprecedented crisis. A dangerous mismatch between soaring production costs and collapsed farm-gate prices has crippled financial viability. Shrimp farmers who once expanded ponds enthusiastically are now contemplating a complete shutdown. The haunting phrase circulating across Andhra’s aquaculture hubs is “Crop Holiday.” This long-form analysis unpacks the root causes of Andhra’s shrimp crisis, the global economic forces shaping the downturn, and what the future holds for India’s $8 billion seafood export industry. The Economic Meltdown: Anatomy of a Shrimp Crisis The Perfect Storm of Costs and Prices Shrimp farming has always carried risks—but never before has the margin turned negative at such scale. Farmers are losing money even in well-managed ponds, upending the economic logic that has powered Andhra’s aquaculture boom for years. The Farm-Gate Price Crash Demand Weakening in Major Export Markets The sudden and steep fall in shrimp prices in Andhra Pradesh is rooted in global market dynamics: Price Levels Below Breakeven Farm-gate prices for common sizes like 100-count and 80-count shrimp have dropped drastically, often falling below the breakeven point of many farms.Farmers commonly report: The result is simple yet devastating: shrimp is being sold below the cost of production. The Escalating Cost of Production (CoP) While revenues fall, costs continue to rise sharply—pushing thousands of small and medium farmers into distress. Shrimp Feed Price Inflation Feed is the single largest expense in shrimp farming, accounting for 55–60% of total costs. Key ingredients—soybean meal, wheat flour, fish oil, krill meal—have all jumped in price due to global commodity volatility.Every major feed brand has increased prices multiple times in the past two years. Mineral, Probiotic, and Water Treatment Costs Intensive Vannamei farming requires heavy usage of: These input costs have risen by 12–18%, adding more weight to the farmer’s burden. Energy and Aeration Expenses To maintain dissolved oxygen (DO) and ensure proper growth, ponds require 24/7 aeration.But today: Seed Quality and FCR Issues Despite farmer complaints, seed quality remains inconsistent in many hatcheries. Poor-quality broodstock leads to: A high FCR means more feed is required to produce the same amount of shrimp—directly increasing the CoP. Global Forces at Play: The Ecuador Disruption Ecuador’s Competitive Edge India is not competing in a vacuum. Ecuador, now the world’s largest shrimp exporter, has dramatically changed global market dynamics. Why Ecuador is Dominating While Indian farmers struggle with rising input costs, Ecuador is able to farm shrimp cheaper and ship it faster to major markets like the US and China. Impact on India’s Prices When Ecuador sells shrimp at lower rates, Indian exporters must: Ultimately, the farmer bears the brunt of this global price war. The Crop Holiday Crisis: When Farmers Stop Stocking Why Farmers Are Abandoning Ponds The concept of a “Crop Holiday”—a deliberate pause in farming—has been gaining momentum across Andhra Pradesh. Farmers Speak with Their Ponds In districts like Bhimavaram, Amalapuram, and Gudivada, it is estimated that 30–40% of ponds have remained idle this season. The logic is devastatingly simple: “If I stock, I lose ₹3 lakhs.If I leave the pond empty, I only lose the lease value.” For many, the math no longer supports farming. Ripple Effects Across the Supply Chain A widespread crop holiday disrupts the entire aquaculture ecosystem: The crisis is no longer just about farmers—it’s about an entire industry in slowdown. Navigating Turbulence: What Can Save the Sector? Emerging Strategies for Recovery Government bodies, exporters, and industry experts are pushing for structural changes to revive profitability. 1. Shift Toward Value-Added Exports India exports mostly raw frozen shrimp. To improve margins: products need to be prioritized. Value addition brings 40–60% higher margins and reduces reliance on commodity pricing. 2. Revival of Black Tiger (Penaeus monodon) Black Tiger shrimp, once India’s pride, is making a comeback.With advances in SPF Black Tiger broodstock, farmers now have a disease-resistant species that yields: This diversification is crucial to reduce dependence on Vannamei. 3. Input Cost Regulation and Subsidy Support Industry bodies are urging policymakers to: A direct reduction in the Cost of Production could ease immediate pressure. 4. Domestic Market Development India consumes very little of its own shrimp.Building a robust domestic shrimp market—through retail chains, processed foods, and institutional buyers—can reduce reliance on volatile export markets. Conclusion: A Turning Point for Indian Aquaculture The shrimp farming crisis in Andhra Pradesh is not merely a “bad season.”It is a structural warning that: have left the industry vulnerable. Yet, Indian aquaculture has a proven history of resilience. The crisis may trigger reforms long overdue—bringing better hatchery management, stronger traceability, diversified species, and smarter technology adoption. For now, the industry waits anxiously.Will global prices recover?Will Ecuador slow down?Will Andhra farmers return to stocking? The coming months will determine whether India’s shrimp ponds revive—or whether the “Crop Holiday” becomes a long, painful new normal.