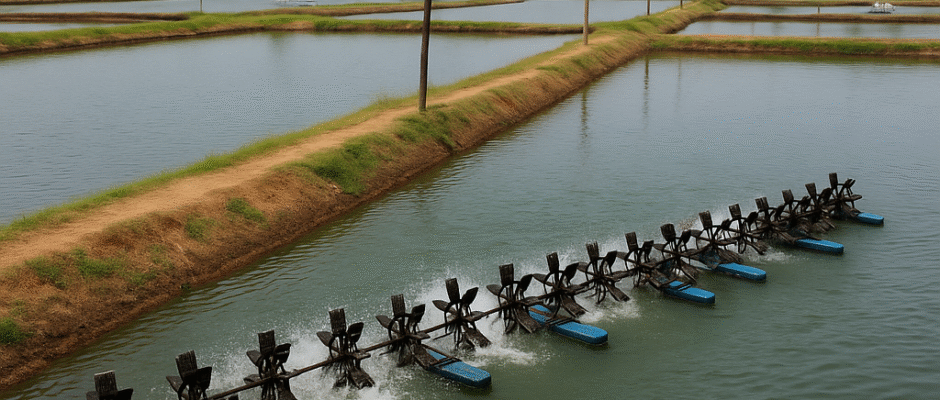

1. Introduction The global shrimp market is in a state of transformation and significant expansion. What was once largely a restaurant luxury or party‐appetiser has now become a mainstream dietary staple across many regions. The shift is being driven by changing consumer preferences, aquaculture advancements, convenience trends, and growing export trade. According to one widely-cited report by IMARC Group, the market size was valued at USD 71.87 billion in 2024 and is projected to reach USD 105.35 billion by 2033, representing a compound annual growth rate (CAGR) of ~3.9% over the 2025-2033 period. IMARC GroupHowever, it is important to note that estimates vary considerably by source, with other reports projecting higher growth and larger market sizes (see later sections for comparison). In this article we will analyse: market drivers & restraints; segmentation (by species, source, form, region, distribution channel); major regional dynamics; competitive landscape & consolidation; trade flows & policy issues; sustainability and technological fronts; and finally future outlook & strategic implications. 2. Key Growth Drivers Several interlocking trends underpin the growth trajectory of the shrimp market: 2.1 Health & Wellness Consumers globally are increasingly shifting away from red meat toward seafood and other lean/alternative protein sources. Shrimp enjoys favourable nutritional positioning: high in protein, low in saturated fat, and recognised for containing omega-3 fatty acids, vitamins and minerals. The health-focused consumer is thus a major driver of demand. For instance, the IMARC report points to “rising demand for protein-rich, low-fat seafood” as a key growth factor. IMARC Group 2.2 Aquaculture and Supply Chain Improvements The backbone of global shrimp supply today is aquaculture rather than wild capture. Farmed shrimp offer year-round availability, more controllable size/quality, and less vulnerability to wild-stock fluctuations. Many market studies report aquaculture accounting for around 60 % or more of global supply. For example, the Grand View Research report states that the aquaculture (or farming) segment held ~61.2% share in 2024. Grand View ResearchTechnological advances — selective breeding, more resilient species (see section 3), improved feed formulations, better disease control, recirculating aquaculture systems (RAS) — all contribute to higher yields, better consistency and cost improvements. 2.3 Convenience, Value-Added Products & Culinary Innovation Shrimp has long been a “premium” menu item at restaurants, but the convenience trend is converting it into a home-meal staple. Frozen shrimp, ready‐to‐cook shrimp, marinated or breaded shrimp products, value-added preparations are growing rapidly in retail. Consumers with less time and more interest in quick, healthy meals are driving this. One report states that the frozen segment dominates because of its storage convenience and the ability to supply at scale. Straits Research+1 2.4 Global Trade & Export Growth Shrimp is one of the most globally-traded seafood commodities. Countries with strong aquaculture or wild catch capabilities export to consume-markets in North America, Europe, East Asia, etc. Trade flows enable producers in one region to meet demand in far-flung markets. For instance, the Food and Agriculture Organization (FAO) reports that global shrimp imports declined somewhat in 2024, but the magnitude and reach of global trade remains vast. FAOHome 2.5 Premiumisation & Dining Trends In foodservice (restaurants, hotels, catering) shrimp remains a premium item — large size (“jumbo” or “giant tiger”), exotic/wild varieties and “gourmet” preparations command higher margins. As incomes rise in emerging markets and dining-out culture expands, this premiumisation supports growth. 3. Market Segmentation Understanding the market means looking at different dimensions: species, source (farmed vs wild), form (frozen, fresh, canned), size/count, distribution channel, region. 3.1 By Species One of the dominant species in the global farmed shrimp market is Penaeus vannamei (whiteleg shrimp). It is favoured because of its adaptability, fast growth, disease resistance, and suitability for intensive aquaculture. According to IMARC, P. vannamei held the majority share of species market globally in 2024. IMARC GroupOther species include Penaeus monodon (black tiger shrimp), various cold-water species, regional varieties, etc. Some reports project P. vannamei’s dominance continuing. For example, Grand View Research cites that segment as ~44.6% of species share in 2024. Grand View Research 3.2 By Source: Farmed vs Wild As noted earlier, farmed (aquaculture) shrimp dominate. According to some reports: Wild-catch still matters, especially for certain premium / cold-water species, but growth potential is more limited, given sustainability and stock-pressure constraints. 3.3 By Form & Processing Forms include fresh/raw shrimp, frozen shrimp, processed/shucked, breaded/marinated, canned, peeled/unpeeled. The frozen segment tends to dominate because of logistics and shelf-life advantages. For example, Straits Research lists the frozen segment (and cold-water) as strong growth segments. Straits Research 3.4 By Size / Count Shrimp size (pieces per pound or per kg) matters in both retail and foodservice. Typical “sweet-spot” sizes such as 41-50 count per pound (for US market) strike a balance of affordability and premium appeal. (The original article referenced this size band as leading segment with ~21.8% market share.) While I did not find a readily cited figure verifying exactly 21.8% globally, such sizing segmentation is common in industry reports. 3.5 By Distribution Channel / End-Use Key channels: Retail/home consumption (supermarkets, frozen retail, e-commerce); Foodservice (restaurants, hotels, catering); Institutional (e.g., schools, hospitals). Many studies show foodservice remains a major channel because shrimp remains a menu favourite. For example the earlier article referenced foodservice at ~32.3% though I could not locate that precise number in the report sources I found—nevertheless the foodservice channel is prominent. 3.6 By Region Regions include Asia-Pacific, North America, Europe, Latin America, Middle East & Africa. 4. Regional & Country Dynamics 4.1 Asia-Pacific The Asia-Pacific region dominates both production and consumption. Countries such as China, India, Vietnam, Thailand, Indonesia play major roles in aquaculture and exports. According to IMARC: China accounted for ~32.7% of the global shrimp market in 2024. IMARC GroupIn India, production rose significantly: from ~0.322 million metric tons in 2014 to ~1.184 million metric tons in 2022-23 (a 267% increase) and export value doubled in the same period. Aquaculture MagazineThese huge growths reflect investments, improved farming, export push, favourable climatic conditions and low labour costs. 4.2 North America & Europe North America is a major consumption/